Thanks to the collaboration between Studia.Bo and Acimga, that provides associated businesses with a variety of specialized reports per product and sales area, we can offer readers a selection of exclusive and up-to-date market data and analysis concerning economies most attractive to export-oriented companies. This time we focus on the important and “sensitive” Russian market.

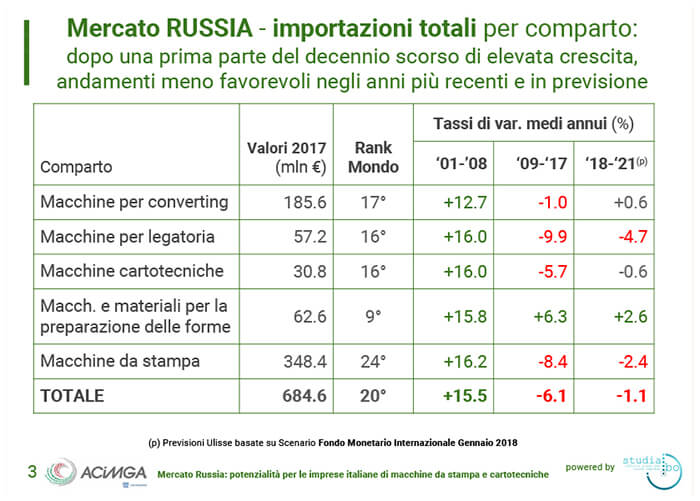

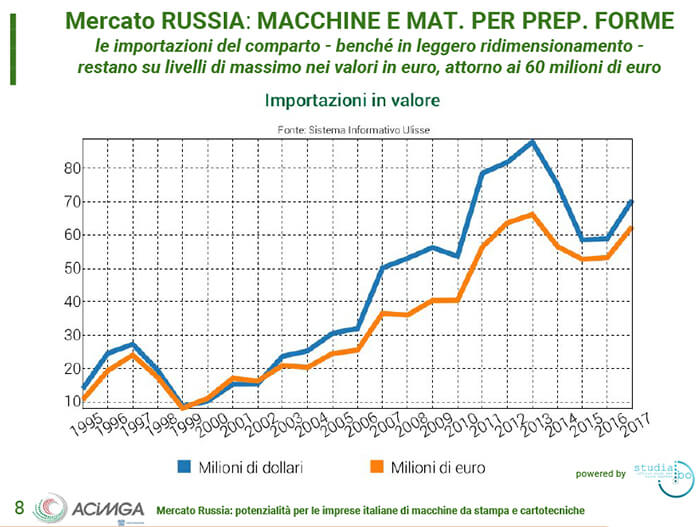

Over the last few years the Russian market has pulled different weights in economic terms. This generally speaking, but also in the Graphics Industry sector. After a particularly high growthrate in the first half of the last decade, in recent years imports of printing and paper converting machines onto the Russian market have shown a downturn. If we analyse the results of total imports for 2017 per segment, The Russian market is only in 24th place in the world ranking for the import of printing presses, while things appear more significant if one considers the main details of imports in terms of the various industrial segments. The table below for example highlights the value of converting, bookbinding or paper converting machines which places Russia in roughly 16th to 17th place in the world, while for example the print form preparation machine segment is in 9th place in the world ranking, and should show an upturn in sales in the period 2018-2021. Indeed, the same table also shows the annual average rates of imports per single segment. As well as the upturn in machines and materials for print form preparation, only one other segments has a + sign for the forecasts for 2018-2012, namely converting machines. On the other hand, annual average figures for bookbinding and printing presses since 2009 show a further drop, after the boom years from 2001-2008 (which had two-digit growth rates for all sectors).

Imports from Italy

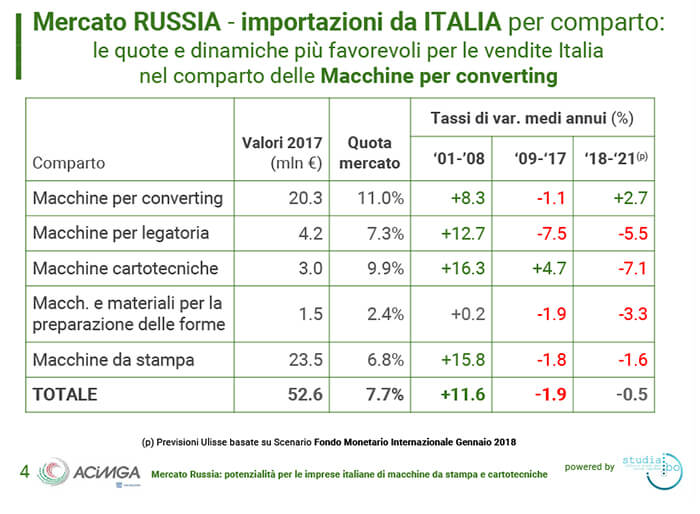

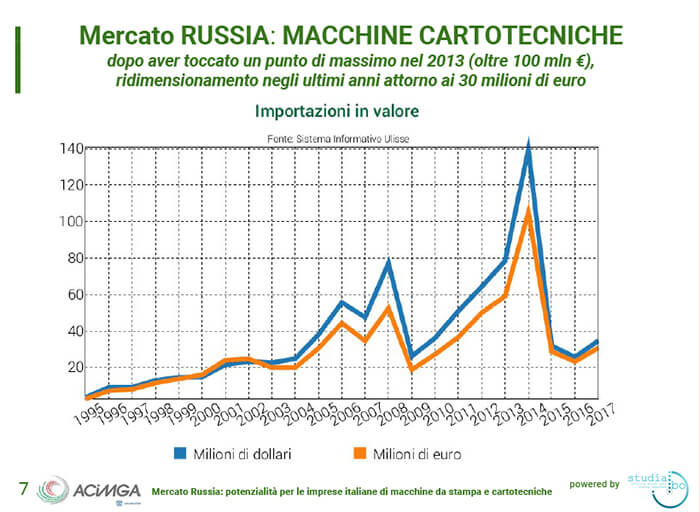

If we abandon the overall analysis of imports onto the Russian market and instead focus on imports from Italy, the converting market can be seen to offer the best expectations for Italian companies. In a market that sees this sector showing an average annual growth of 0.6% from here back to 2012, Italy would seem to play an important role, given that an expected growthrate of exports of converting machines towards the Russian market of + 2.7% has been forecast. In Table 4 we find a detailed breakdown of the dynamics of exports from Italy to Russia for the single industrial sectors. Italy has a market share average of 7.7%, with a maximum peak for converting machines (accounting for 11% of the value) and a minimum of 2.4% for machines and materials for print form preparation. If converting machines are seen to have a future for potential growth, the situation is different with regard to paper converting machines, which, after a constant year-on-year growth from 2001 to 2017, are starting to show signs of a downturn, with the share of Italian imports all the while accounting for 10% of the total volume entering Russia.

A more detailed look

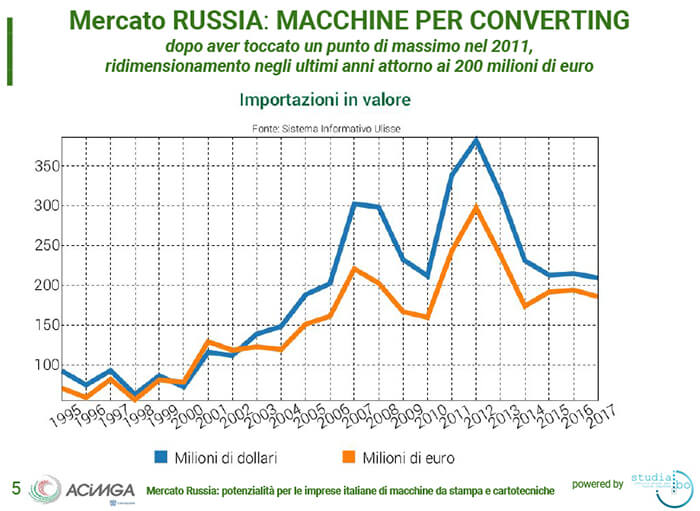

In the tables below we can observe the trends of the total imports of Russia in the various product sectors. The trend reflects for all the sectors what is stated at the beginning of the article: the years around 2011- 2012 and 2013 were those of maximum growth for the internal purchasing market, showing a trend that has rewarded foreign manufacturers of both converting and paper converting machines. For converting, the best year was 2011, when the value of imports reached almost 300 million euros, followed the subsequent year by the approx. 250 million euros of book binding machines. Today the Russian economy has brought the market values back to lower levels, although even in 2017 the import of machines for the graphics sector totalled 680 million euros, 53 of which accounted for by Italian suppliers and manufacturers.

Flexo sees Italy leading the way

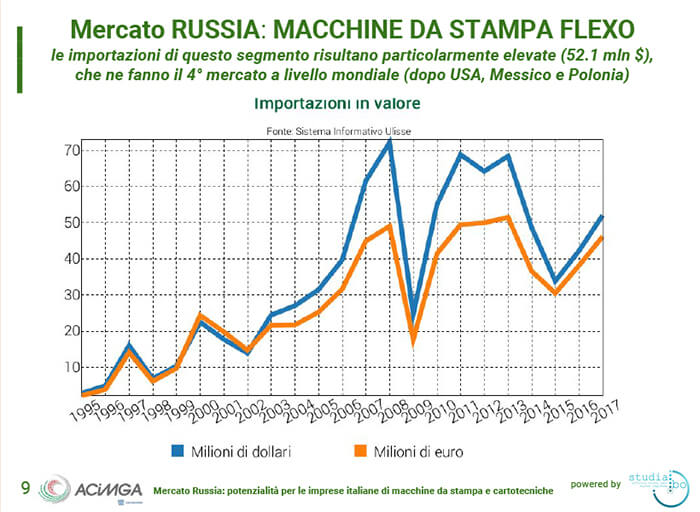

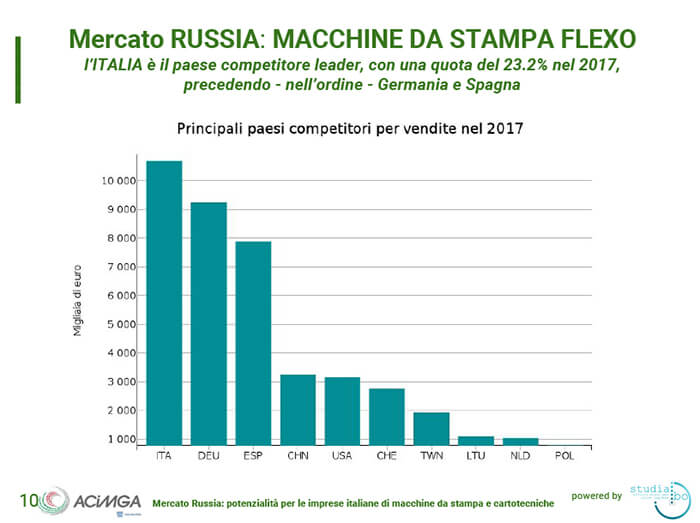

Flexo printing machines deserve a specific mention. The last two tables clearly demonstrate Russia’s specific value for this market. The first one shows that there is a stability of average investments of over 50 million euros for flexo machines, with a couple of negative peaks in 2009 and 2015, which however saw immediate recovery in the following years. Russian imports in this segment are hence particularly high and make Russia the 4th market in the world after the USA, Mexico and Poland. An important market overall, but even more important if we look at Italian interests. In the second we see in fact that among the main competitor countries in the sales of 2017 as a country Italy put in the best performances, surpassing Germany (in second place) not to mention Spain (classed third).