Acimga’s data on the performance of printing and converting machinery in the first year of the Covid Era and the encouraging forecasts of recovery in instrumental mechanics.

The reports of the Centro Studi Acimga document, quarter after quarter, the performance of the Italian printing machinery industry during the first year of the pandemic: the dramatic -16.1% of orders acquired in the first quarter of 2020, the milder -1.4% in the following quarter (comparisons are with the same periods of the previous year) and the almost encouraging +1.3% in the August-September quarter. Uncertainty, however, persists: at the end of the year orders registered a drop of -1.6% and expectations are equally divided between stability (50%) and variations (half for the better and half for the worse). Replaced on an annual scale, orders are down 5.7% in 2020 compared to 2019, with -12.7% domestic orders and -2.9% foreign orders.

These figures are countered by a recent press release from Federmacchine that, while documenting the great losses suffered by instrumental mechanics in 2020 (-17.9% on 2019) on the other hand, foresees an encouraging growth in 2021, with +8.9% due to both exports (+10.8%) and deliveries on the Italian market (+12.4%).

Broad view: the fourth quarter 2020 of machines

For printing and converting machinery manufacturers, the last quarter of last year ended in uncertainty. Here, from the Acimga Studies Office report, are the most significant listings.

Orders acquired -1.6% The index of orders collected in the fourth quarter of 2020 recorded a slight decline (-1.6%) compared to the same period last year, for an index value of 163.7 (Base 2015=100). The result was positively influenced by the growth recorded on foreign markets (+1%), while on the domestic market, order intake fell by 10.5%. Overall, in 2020 orders decreased by 5.7% compared to 2019: -12.7% domestic orders, -2.9% foreign orders.

Turnover -6.6% in value In the fourth quarter of 2020, the value of turnover fell by 6.6% compared with the same period of the previous year (in current terms) to EUR 552 million. In year-on-year terms, the decline was 15.8% compared to 2019.

Stability forecasts In the period under review, the economic forecasts on turnover trends for the first quarter of 2021 indicate stability for 50% of respondents (up from 40% previously); the rest of the responses are equally divided between growth and decline.

Export share: expectations In the period October-December 2020 the forecasts regarding the export share of turnover for the first quarter of 2021 are, for the majority of respondents (55.6%), stable. Decline and growth follow, both at 22.2%.

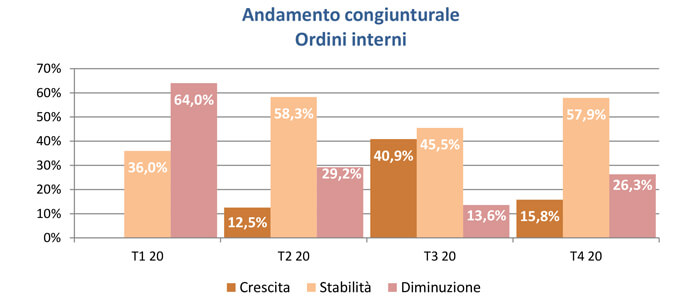

Forecast of orders acquired For the first quarter of 2021, forecasts on the economic trend of orders acquired in the domestic market indicate stability for 57.9% of respondents compared to the fourth quarter of 2020; this is followed by decreases (26.3% from 13.6%) and decreases in growth (15.8% from 40.9%).

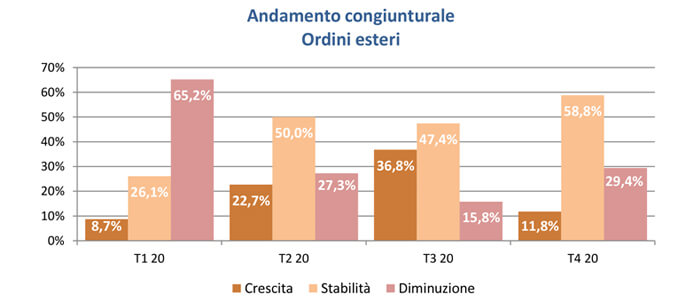

Stability is also predominantly expected for foreign markets (58.8% of respondents); followed by decrease, at 29.4% (from 15.8%) and growth at 11.8% (from 36.8%).