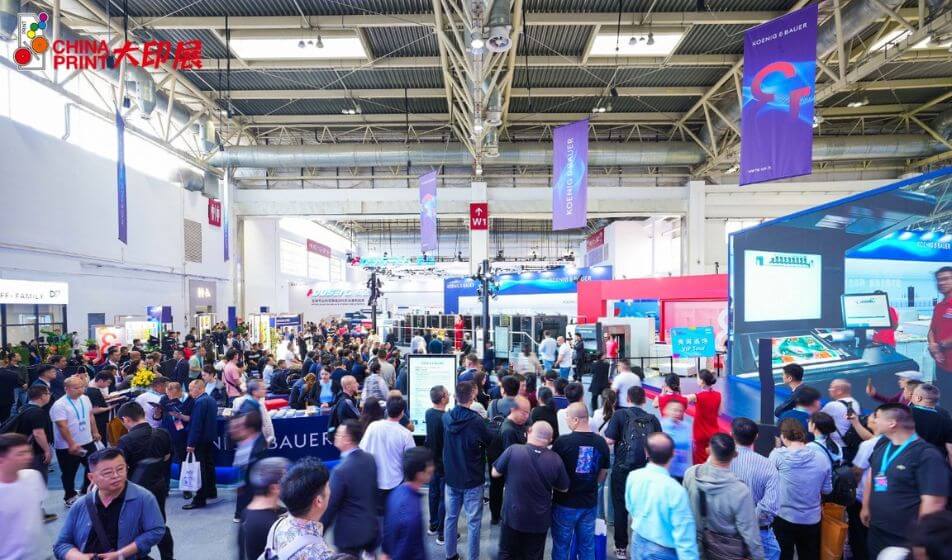

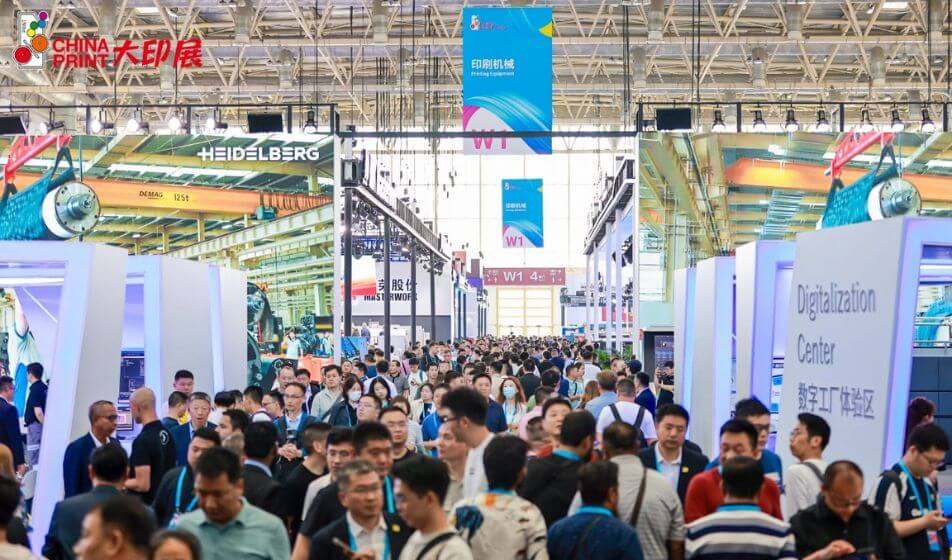

To do business in China, it is essential to understand how the large and complex local printing market is evolving, in which directions demand is oriented and what technologies are emerging. We thank Mr. Bin YANG, Vice President of PEIAC and Chairman of CPSC for answering Converting Magazine’s questions.

Mr. Bin Yang, Vice President of PEIAC and Chairman of CPSC

Mr Bin Yang, what do you think is changing now in the Chinese market of packaging printing and converting, and with what perspectives? In particular, what kind of products and technologies are more in demand now from Chinese printers and converters of flexible packaging?

There are different shifts taking place worth noting. First of all, the demand for personalised packaging in short runs is growing, in second instance, the cost of labour is rising and converters feel the need to increase the level of machinery automation to increase efficiency and production quality and further contain costs. As a third point, the demand for sustainable, eco-friendly and ecologic packaging will continue to grow, not only as a government-issued regulation requirement, but also as inevitable social development trend. Equipment manufacturers from various countries, including Italy, will certainly benefit from the Chinese market if they have new technologies and products that meet the above requirements.

So even in China small print runs are becoming popular?

With the consumer market transitioning from standardised to customised production, brand owners are increasingly launching small-batch, multi-version packaging solutions to meet consumers’ pursuit of uniqueness. In the food and beverage sector, for instance, orders for festival-limited packaging and region-specific product packaging have been growing year after year, driving a sharp increase in demand for short-run printing equipment among printing enterprises. The explosive development of e-commerce logistics has further spawned the “drop-shipping” packaging model, forcing printing equipment to upgrade toward quick plate changing and flexible modular adjustment.

And labour costs are rising…

Yes. And driven by the continuous rise in labour costs, printing enterprises are feeling an increasingly urgent need to enhance equipment automation, aiming to further reduce production costs through dual optimisation of productivity and quality. The Chinese industry is also increasingly eager for equipment that guarantees ease of use and a high degree of automation.

How is the automation process progressing in Chinese industry? Which types and segments of production processes are interested from automation? With which goals?

Intelligent equipment such as robotic arms and AGVs have achieved large-scale application in printing plants, mainly covering scenarios such as loading, unloading, and material handling. These systems are gradually replacing traditional manual operation models, effectively reducing labour intensity, cutting labour costs, and significantly decreasing the incidence of work-related injuries.

Is the lack of skills and experience among technicians and workers also a problem in China?

The Chinese printing industry boasts a considerable pool of highly skilled talent, but the main challenge currently lies in the low career aspiration among young professionals, who commonly perceive the sector as a traditional low-end industry. With the deepening of digitisation and automation in printing plants, fundamental changes are taking place in the working environment and operational activities: the industry is gradually transitioning from a traditional labour-intensive model to a high-end manufacturing sector equipped with modern equipment and intelligent management systems, which is expected to attract more specialised talent in the future.

How does this increased sensitivity to environmental issues manifest itself?

The market demand for green, eco-friendly, and sustainable packaging is growing strongly, a trend rooted in both strengthened government regulations and the inevitable direction of social development. For global equipment manufacturers including those from Italy, the launch of new technologies and products that align with the above demands will undoubtedly gain wide favour in the Chinese market.

How did this progress on sustainability translate in the printing and converting industry?

China has established clear regulatory requirements for VOCs emissions from printing plants, which not only urge printing companies to adopt more environmentally friendly raw and auxiliary materials and clean production processes, but also mandate centralised collection and treatment of excessive VOCs to reduce pollution emissions. Against this backdrop, innovative raw and auxiliary materials such as eco-friendly inks, chemical-free processing plates, environmentally friendly dampening solutions, and eco friendly washing solutions have been introduced, while new eco-friendly materials like degradable paper-plastic composites have achieved large-scale application in multiple sectors including food packaging and e-commerce logistics.

At last drupa in Düsseldorf there was a huge number of Chinese exhibitors and all the world has seen their great progress in quality and performance. In which categories of products/technologies do you think Chinese manufacturers are winning now, compared to western competitor? Which are their main competitive advantages? And the actual gaps to fill?

The Chinese manufacturing industry for printing equipment is reaching a level of comprehensive development across the entire industrial chain, with remarkable breakthroughs particularly in the fields of digital printing and post-printing processing – a complete technical system covering both book and packaging post-press processing and that has reached large-scale competitiveness. Its main competitive advantage lies in cost-performance: the quality of Chinese equipment shows a continuous upward trend, while it has significant competitive advantages in terms of cost and price.

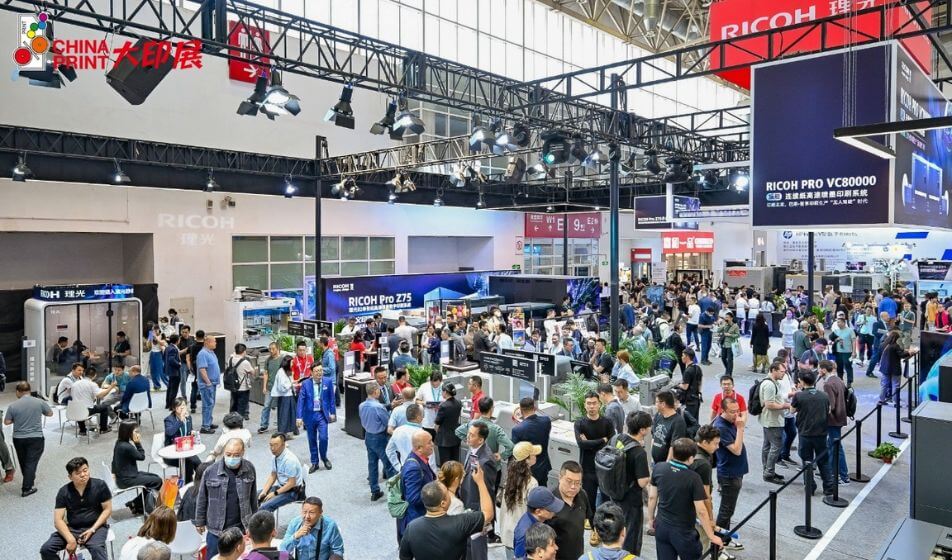

Which printing technologies are the most widespread in China? And the emerging ones? What are the share market of roto, flexo, offset and digital printing machines? And the application fields of each of them?

The growth rate of digital printing is significantly higher than that of traditional printing, with the two technologies catering to distinct application scenarios and job types. Printing plants typically use both traditional and digital printing equipment, and even purchase products from multiple manufacturers for the same type of equipment. The rationale behind this choice lies in the fact that each device has unique technical advantages and application limitations, requiring printers to assign production tasks to the most suitable equipment based on job characteristics. It is evident, therefore, that digital and traditional printing are not simple substitutes for each other, but rather complement each other functionally to meet diverse production needs.

What opportunities are opening up for foreign technology exporters?

For global equipment manufacturers, including Italian manufacturers, the structural opportunities offered by the Chinese market are particularly significant: as the world’s largest printing and packaging market, Chinese printers demonstrate formidable purchasing power for equipment. It is clear that technological innovations targeting the main critical points of demand mentioned in this talk will become the key to unlocking the Chinese market.

With which kind and level of solutions? For which applications?

Products featuring high quality, cost-effectiveness, high automation, and compliance with green sustainable development standards will gain increasing favour.

* Special thanks to Cecily Pu for her invaluable help; without her, this interview would not have been possible.